LIFE INSURANCE FOR VETERANS

Helping Protect Your Family

and Your Future

You protect Our Nation... Let us Help You Protect your family

My name is Gerry Ruffino

Helping EDUCATE and PROTECT our Veterans is my top priority

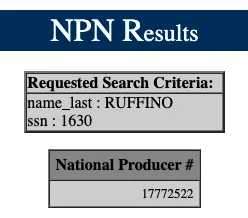

Below is a picture of my Driver's License as well as my National License Producer Number

I go through extensive training and background checks to be able to offer my services to help you and your family.

MY CREDENTIALS

DRIVERS LICENSE

NATIONAL PRODUCER NUMBER

This National Producer number is equivalent to a business social security number

This is always important to know as a client

Life Insurance For Veterans Agency Specializes in Funeral Insurance Across the United States

We work with over 30 reputable insurance companies, so you can compare plans to get the best final expense insurance for you at the best price. This includes VALife.

Significant Savings

Compare prices from the top burial insurance providers that could save you up to 58% on your coverage

Customized Quotes

Get an actual final expense quote from multiple companies from me, a Specialist who has your best interest in mind.

Trusted Partnership

You are assigned ONE of our Veteran Specialist who are committed to working on your behalf to secure you the best coverage

Proven Expertise

Final Expense insurance for veterans is our specialty. Receive experienced guidance to help make the best decision for you.

Does the VA Pay for all final expenses for all veterans?

The amount of money that the VA (U.S. Department of Veterans Affairs) pays for a veteran's funeral or cremation depends on several factors, including the veteran's circumstances of death and whether the veteran is buried in a national cemetery or a private cemetery.As of 2021, the maximum burial and funeral expense allowance for non-service-connected deaths is $796. This allowance can be used to reimburse the veteran's family for funeral or cremation expenses, transportation of the remains, and other related costs.If the veteran's death is related to their military service, the VA may provide additional burial benefits, which may include an increased burial allowance and a headstone or marker for the grave. In addition, the VA may provide a burial flag and a Presidential Memorial Certificate to honor the veteran's service.

What is Whole Life Insurance?

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual, as long as the premiums are paid. It offers both a death benefit and a cash value component. Here are some key features of whole life insurance:

Lifetime Coverage: Unlike term life insurance, which provides coverage for a specified period (such as 10, 20, or 30 years), whole life insurance offers coverage for the entire lifetime of the insured person. As long as the policy remains in force and the premiums are paid, the death benefit is guaranteed.

Death Benefit: The primary purpose of whole life insurance is to provide a death benefit to the beneficiaries upon the insured's passing. The death benefit is typically a tax-free lump sum payment that can help beneficiaries cover funeral expenses, outstanding debts, or provide financial support for loved ones.

Cash Value Accumulation: Whole life insurance policies have a cash value component that grows over time. A portion of each premium payment goes toward this cash value, which accumulates on a tax-deferred basis. The cash value grows gradually, typically at a fixed or minimum guaranteed rate of return, depending on the policy.

Tax Advantages: The cash value in a whole life insurance policy grows on a tax-deferred basis. This means you don't have to pay taxes on the growth as long as the funds remain within the policy. Additionally, policyholders can access the cash value through policy loans or withdrawals, often on a tax-free basis, providing a source of funds for various purposes such as emergencies or supplementing retirement income.

Level Premiums: Whole life insurance policies usually have level premiums, meaning the premium payments remain the same throughout the life of the policy. This can provide stability and predictability in terms of financial planning.

Premiums compared to term life insurance. However, the lifelong coverage and the cash value accumulation can make it an attractive option for individuals seeking permanent life insurance protection with potential financial benefits during their lifetime.

What is Term Life Insurance?

Term life insurance is a type of life insurance policy that provides coverage for a specific period of time, usually ranging from 1 to 30 years.

Term life insurance policies are typically purchased to provide financial security for the policyholder's loved ones in case of their unexpected passing. If the policyholder dies during the term of the policy, the death benefit is paid out to the policyholder's beneficiaries.

Term life insurance policies do not have a savings component or cash value, and the premiums are typically lower than those for whole life insurance policies. The premiums remain fixed for the duration of the policy term, and the policyholder can choose to renew the policy or let it expire at the end of the term.

Term life insurance policies are often used to cover specific financial obligations, such as a mortgage or education expenses, or to provide income replacement for the policyholder's loved ones. They can be a cost-effective way to provide temporary coverage and peace of mind

What is an Index Universal Life Insurance Policy

An Index Universal Life Insurance (IUL) is a type of permanent life insurance policy that offers a combination of a death benefit and a cash value component. Here are the key features of an Index Universal Life Insurance policy:

Death Benefit: Like other types of life insurance, an IUL policy provides a death benefit. This means that if the insured person passes away while the policy is in force, a tax-free payout is made to the designated beneficiaries.

Cash Value Component: What sets IUL apart from traditional life insurance policies is the cash value component. A portion of the premiums paid into the policy is allocated to a cash value account. This cash value grows over time on a tax-deferred basis, meaning you don't pay taxes on the growth as long as it remains within the policy.

Indexed Interest: The cash value in an IUL policy can be linked to the performance of one or more stock market indices, such as the S&P 500. The insurance company credits interest to the cash value based on the performance of these indices, subject to certain limits and adjustments.

Participation Rate: The participation rate is a factor that determines how much of the index's gains will be credited to the policy's cash value. It is set by the insurance company and can vary from one policy to another.

Floor Protection: Most IUL policies also come with a floor or minimum interest rate. This means that even if the underlying index performs poorly or goes negative, the policy's cash value will not decrease below a certain level.

Flexibility: IUL policies often offer flexibility in premium payments, allowing policyholders to adjust the amount and frequency of premium payments within certain limits. This can be useful in managing the policy's cash value and death benefit.

Tax Advantages: IUL policies offer tax advantages. The cash value growth is tax-deferred, and policyholders can often access this cash value through tax-free loans and withdrawals, as long as certain conditions are met.

Surrender Charges: In the early years of the policy, there may be surrender charges if you decide to cancel the policy or withdraw a significant portion of the cash value.

Some of the Companies I Work With